We often hear how listening to the voice of your customers is foundational to a sustainable business.

But here’s the pickle – companies are always in a tug of war between Qualitative vs. Quantitative feedback research without analyzing what kind they need.

We know quantitative research aims to quantify data points based on users’ journeys, like the NPS survey. In contrast, qualitative user research collects data on more niche attributes like user behavior, preferences, and more.

The challenge is to pick the right methodology that fits your use case and requirements.

So, stick to the end if you’re also trying to piece it together and barely succeeding at identifying which research method is best for your business.

We’ll explore how to balance qualitative and quantitative research, their types, different analysis methods, and more.

Let’s begin!

Qualitative vs. Quantitative Research: Understanding the Difference

Let’s see how qualitative and quantitative research methods differ and how you can balance the two to achieve remarkable results.

Here is a comparative overview of qualitative vs. quantitative feedback data and what sets them apart.

| Parameters | Qualitative | Quantitative |

| Concept | Aims to understand human behavior, preferences, and needs from an interviewee’s point of view. | Aims to understand human behavior, preferences, and needs from an interviewee’s point of view. Focuses on collecting facts about social phenomena |

| Objective | Concerned with discovering social phenomena, unconscious or conscious.

Explores the psychological mechanisms via interaction with individuals or analyzing individual responses online. |

Collects quantifiable data, which is easy to visualize.

Measures the past and predicts the future. Help verify speculations and hypotheses made during qualitative research. |

| Methods to collect | Ethnographic research Heuristic inquiry Online surveys (using Sentiment Analysis) User testing Phenomenology Focus groups Grounded theory |

Digital analysis Technical analysis Online survey research Causal-comparative Correlational (Descriptive research) |

| Pros | Offers in-depth insights Budget-friendly Collects contextual data |

Highly objective Easy to collect Easy to analyze and visualize Identifies trends |

| Cons | Not reliable in all cases Requires manual efforts (except for online surveys) Highly subjective |

Lacks in-context data High on cost |

| When to use | To perform market research To add a human touch to your research To develop hypotheses |

To perform market research To get general feedback To validate Hypotheses |

To understand these concepts better, let’s have a look at them in detail:

What is Qualitative Feedback?

As the name suggests, qualitative research focuses on the quality of the data, the non-numerical aspect of the research. It provides insights based on non-statistical and semi-structured data.

A report published by Open University Press states —

”Qualitative analysis allows for ambiguities/contradictions in the data, which are a reflection of social reality.”

Qualitative research goes one step further than quantitative research and gauges the underlying factors of what the feedback data represents, such as opinions, motives, reasons, and so on. The insights from the qualitative analysis can be inferred to draw conclusions, which may be subjective in some cases.

In simple words, it puts context to the quantitative feedback data and answers the ‘why’ behind the data.

It establishes qualitative data as explanatory and aims to represent the topic instead of measuring it like the other data type.

Although it helps understand the data in detail, it makes analysis harder, unlike graphs that are comparatively easy to decipher.

Qualitative research is collected first-hand, like observation via interviews, and can be collected via Artificial Intelligence technology like Sentiment Analysis. The verbatim feedback collected via surveys is easy to analyze with the Sentiment Analysis feature to derive qualitative insights.

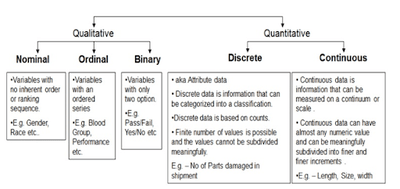

3 Types of Qualitative Feedback Data to Focus On

There are three types of qualitative data you should be collecting in your feedback to get a holistic view of your user experience.

- Binary data

Binary qualitative data separates things into mutually exclusive (distinct) categories like yes/no or true/false. The main use case for this type of data point is to segregate the users into two groups for better control.

- Nominal data

Nominal data is data that’s labeled or named without any numerical value. You can use this data to differentiate between data sets. For example, MCQ-type survey data can tell much about respondents’ preferences, behavior, and more.

- Ordinal data

Ordinal data is the data set arranged in an order on a ranging scale. The order of the qualitative data matters the most in this data type.

For example, NPS surveys use a scale of 0-10 to gauge customers’ loyalty. Here, each number on the scale represents the loyalty of the respondents.

Importance of Qualitative Feedback: The Good & the Bad

One of the obvious pros of qualitative research and data is that it aims to collect data that is not quantifiable, like preferences, attitudes, challenges, etc., which provide different insights than quantitative data.

Another benefit is that you can conduct qualitative research via one-on-one interviews to observe participants or use Sentiment Analysis which feedback survey tools like Qualaroo offer.

Besides these benefits, here are some more points highlighting ‘the Good’ about qualitative data.

The Good

In-Depth Insights

Since qualitative research includes conducting interviews, it is possible to get a gist of users’ past experiences, feelings, and reactions towards new ideas about products

The results from the observation are helpful to discern what features users will appreciate in the product, what elements they should look for while designing the interface, and numerous such decisions which should and can be made user-centric.

Qualitative feedback also tells what customers/users think about a product or service, where customers are getting stuck in the customer journey, and more. Companies can act on such insights to improve in all aspects.

Not Heavy on the Budget

Compared to quantitative, qualitative research provides in-depth feedback data at a much lower cost. It doesn’t require surveying large groups; instead, it supports observing smaller targeted groups and derives relevant contextual data. It requires forming small focus groups and interviews, which are not demanding on the budget.

Gives Abundant Contextual Data

Qualitative research is all about the context, so we had to mention this benefit separately. Qualitative survey questions are generally open-ended to allow users to express themselves and get in-context feedback.

The open-ended questions are followed up by more questions to gauge the hows and whys for their responses. The goal is not to confirm what is already known via quantitative feedback data but to explore the emotions and perceptions within the data.

Example

You can tell that customers abandon their carts with quantitative feedback vs. qualitative feedback that will answer the reason behind the shopping cart abandonment.

You can reveal trends, behavioral patterns, and indispensable insights to create unparalleled marketing and product development strategies.

Related Read: How to Use Qualitative Data to Improve Your Blog

The Bad

To some, one of the biggest drawbacks of qualitative data is that it does not offer countable accurate data. How you see this point is entirely subjective and based on what you prefer.

So moving on, here are some cons of qualitative feedback that you should know to set reasonable expectations from your qualitative research.

Sometimes Unreliable

In some practical scenarios, where qualitative insights are rendered unreliable, quantitative feedback data thrives. It is due to external factors which cannot be controlled but affect the data inevitably.

Some qualitative data methods don’t signify the exact number of people surveyed, support extrapolating results, or fit when applied to a broader audience.

Demands Manual Efforts

Similar to other drawbacks, this one is also applicable to some qualitative research methods. Some methods require you to analyze the data manually, which is a labor-intensive task. It includes interviews, data from focus groups, with the Sentiment Analysis method as an exception.

Highly Subjective

Feedback data extracted from the majority of the qualitative methods are not replicable. The results are subjective since the researchers, interviewers, or observers of data decide which piece of information is relevant or not. Thus, the interpretation of the data varies.

How to Collect Qualitative Feedback Data

Now that you know what qualitative research entails, let’s move forward to the ‘How’ part of it i.e. How to collect qualitative data.

Below we have discussed the qualitative research methods that help collect qualitative feedback.

Ethnographic research

Popularized by Anthropology, the Ethnographic research method has now become a critical part of qualitative research. It studies trends, behaviors, pain points, and cultures in a real-life environment.

It is geography-driven, meaning it involves researching and observing in a particular geographical location. The geography is flexible and can range from a small entity to a country as a whole.

Let’s take an example of how ethnographic research works:

You can refer to this qualitative research method to study and collect data for usability, service design, and user-centric design problems of a product.

It helps designers develop a detailed understanding of design challenges, how to bypass those challenges, their target audience, processes, and more. The ethnographic method is undoubtedly time-consuming, and on top of it, cannot be limited to a specific timeframe.

Heuristic Inquiry

A Heuristic analysis report explains the approach as research aiming to find “meanings and essence in the significant human experiences.“

Although a crucial tenet of research is not to rely on opinions and assumptions and trust only factual data, this approach is an exception. Applying a heuristic approach to your qualitative research means conducting an experience-based experiment and analysis by a field expert.

An expert’s opinion on something might be subjective, but it’s still valuable as it can provide deep insights. It is because an expert will assess their own experience with your services or products to bring forth profound insights.

Example

An expert’s assessment of a mobile app or a website entails specific parameters on which they analyze their experience.

For example, while assessing a mobile app user experience, a few questions frequently asked in the process are:

- Did the mobile app offer an expected user experience?

- Is the user interface of the app user-centric?

- Is the mobile app easy to navigate?

- Is the content on the mobile app insightful and clear to understand?

- Which feature of the mobile app needs improvement?

- Which feature of the mobile app adds no value to the user experience?

Please note that this approach is more about the process than the end result. The takeaways from the research are not concrete but only serve as a part of a bigger picture which is the wholesome insights from qualitative research.

The main aim of heuristic inquiry in qualitative research is the “incorporation of the researcher subjectivity when undertaking the research.”

Online Customer Surveys

On-site surveys are all the rage these days, thanks to their high response rate. In fact, Qualaroo’s in-context surveys achieve a 10-30% response rate due to their immediate and seamless placement within the user experience. If you wonder whether surveys are qualitative or quantitative, the answer is simple – they are both.

These surveys are an excellent tool for gathering in-context feedback and tapping into valuable qualitative and quantitative insights.

There are different types of surveys that you can deploy to gather qualitative feedback from the customers. For example:

Exit-intent surveys are fantastic for understanding why the customers left your website without completing the goal. This survey type appears right when the user is about to leave the website and asks questions similar to this:

Five-second test surveys are another great option to understand what kind of first impression users’ have about a product, service, etc

On-site content surveys can help you identify whether the current content is valuable or lacking in some ways. You can even ask users to suggest topics or information they would like to see and tap into new content opportunities

To better represent the impact of online surveys in qualitative research, let’s look at this case study.

Case Study: Belron

A windshield provider company, Belron, saw a huge bounce rate on their website even though their targeted customers are those who need to replace a broken windshield – an essential product.

To find the missing piece of this puzzle, which only leaving customers can give, Belron took the help of Qularoo’s exit-intent surveys to ask its leaving website visitors what they were looking for but couldn’t find on the website.

Not only did it help them understand the reason behind the bounce rate, but they also discovered different user personas in the process.

Related Read – Here is our list of 25 Best Online Survey Tools

User Testing

In user testing, also known as usability testing, you gauge the usability of a product. In this content, by user testing, we mean testing your users by asking them a series of questions to gauge their point of view and general sentiment towards products, services, or overall customer experience.

User testing can be done during interviews and focus group meetings for direct interaction with the participants.

Another way is to use usability testing tools with features like session recording, heatmaps, and more to analyze users’ actions on a website and summarize their behavior in the form of qualitative data.

Read More – 20+ Best Customer Experience (CX) Management Software

Phenomenology

Another significant qualitative research approach is Phenomenology. The approach requires the observer/researcher to gather ‘verbal or written protocols describing the experience.’ (McLeod: 2011: 89)

In simple words, this method involves analyzing a particular event or a phenomenon as qualitative data to understand how and why a phenomenon takes place and its scope on the impact on the respective research topic.

This research method uses qualitative data procured from different sources such as interviews, documents, surveys, videos, and data from experiencing the phenomenon first-hand.

Focus Groups

Throughout the article, we mentioned how qualitative research aims to understand the intents, perspective, behavior patterns of the targeted audience; this is one of the methods to achieve it.

A focus group can have participants from 5 to 50, depending on the scope of the research. Tools such as online surveys collect feedback data from the participants on a particular topic, issue, product, service, etc.

Later, the data is analyzed to point out behavior patterns or intentions behind why the audience behaves the way they behave on a website or towards a brand, service, or product.

Note*

Since the focus groups require hiring participants, they need a lot of managing and planning, making it a complex and costly process.

Case study

Case studies are compiled documents of intensely detailed analysis, covering any topic from a brand, product, services, and much more. Qualitative research employs case studies as an instrument to analyze data about a topic and procure insights.

Grounded Theory

Grounded theory is an appropriate method to analyze the data collected from the focus groups and case studies. It entails developing theoretical explanations about actions or a process.

In simple words, the grounded theory explores the cause behind a reason. For example, why a user took a specific action. The theory helps conceptually analyze the qualitative data and draw theories based on first-hand observations.

The sample size of analyzed groups can vary between 2 to 100. There are two critical reasons why this theory is prominent in qualitative research:

- Firstly, it provides clear and streamlined guidelines for qualitative research, and

- Secondly, it validates qualitative research as a scientific inquiry.

Example

Suppose a company notices a continuous fall in a product’s demand. In that case, a grounded theory will help them get into details of instances leading up to the final action – the customer not buying the product.

The intense observation of the whole situation by asking open-ended questions in focus groups will get the company the answers they seek.

Text Analytics

Text analytics is a part of Natural language processing (NLP) that helps find sentiment in unstructured text. You can analyze feedback in the form of text, video, and audio and explore the underlying customer sentiment.

Under this method of qualitative analysis, the data is displayed in the form of word clouds which helps visualize feedback. It shows the most used vocabulary in different colors and sizes, referring to the frequency of the words used in the feedback.

Online Reviews

Unsolicited feedback like online reviews on forums and social media is nothing short of a goldmine of insights for every business. They let you hear the voice of customers and how they feel towards your company.

You may not be able to get such authentic and natural responses on the surveys. These reviews provide rich qualitative feedback that companies can use to improve customer experience.

Recommended Read: How Customer Feedback Can Be Your Effective Growth Mechanism

What is Quantitative Feedback?

It’s a study of numerical data which quantifies collected data. It focuses more on statistics than facts. Quantitative feedback research on this type of data is best to identify averages and patterns, make predictions, generalize data to a broader audience, and so on.

Quantitative feedback data provides an empirical foundation on which businesses can base their seven-digit decisions.

It is also conversely appealing because it appeals to the rational and the logical side. For this reason, it’s a better option to employ to get buy-in from the executive level in a company. It analyzes opinions, behaviors, attitudes, etc., and quantifies the result.

Like a well-made presentation in a board meeting, it’s always nice to have examples while learning something.

The graph below is a representation of quantitative data procured from surveys. The data in its true form (left side) represents Netflix’s users’ behavior and preferences, while the graph on the right quantifies the said data and shows a statistical report.

Tools such as interviews, longitudinal studies, online surveys, behavioral observations, etc., are used to ask quantitative questions concerning how much, how long, and how many. The results are generally applied to a larger population.

The best time to use quantitative research is when you are sure of what questions you need to be answered.

Quantitative data research is good for when you want to:

- Identify trends or patterns

- Know what users do on your mobile app or website

- Know how it’s performing for them, and much more.

2 Types of Quantitative Feedback Data

There are essentially two types of Quantitative data: Discrete and Continuous. Let’s understand each one to grasp the depths of what quantitative data is.

Discrete Data

Discrete data is a type of data that cannot be measured but only counted. It consists of integers like 1, 5, 10, 100, -10, -100, and so on and cannot break into small parts. It eludes measurement categories such as height, weight, length, mass, etc.

In a way, discrete data can be countably finite or countably infinite.

Examples

How many units Tesla sold, how many oranges are in a crate, how many people watched the movie on the premiere day, etc. All represent a countably finite number. Whereas how many hair strands are on a person’s head, how many stars are there in a night sky, etc., are countably infinite.

Qualitative data is mainly categorical, but so can be discrete data.

For example, people traveling in a flight from different ethnicities and countries are both discrete and whole.

If you want to identify discrete data, ask these questions:

- Can you count it?

- Can you divide it into small parts?

In essence, any whole integer number is discrete data that doesn’t consider half values.

Continuous Data

Unlike discrete data, you can measure continuous data on scales like weight, height, length, speed, age, and so on. It has a numeric value and can be infinitely broken into smaller parts.

Examples

The speed of your car on a highway, the time it took for a ball to roll from point A to point B, the amount of time you took to prepare a meal, and more.

Continuous data is either uncountably infinite or uncountably finite.

For example, the percentile of a student out of 100 is uncountably finite. A student can score anything from 52.5%, 87.6783%, to 99.9999%, and more as long as there is an upper bound (100%) and a lower bound (0%).

Whereas uncountably infinite data can be seen as a set of real numbers like 3, -1, 0, 2, 5, 8, etc. since there is no upper or lower bound.

Quantitative Feedback: The Good and the Bad

Let’s look at all the strengths and weaknesses of quantitative feedback data to understand when and where you should use it.

The Good

Objective in Nature

Since the data heavily depends on statistics and numbers analyzed during the research, it leaves no room for bias suspicions. Anyone with doubts can refer back to the data anytime to cross-check.

Easily Analyzed

Unlike qualitative data, quantitative data is easy to analyze with tools like Google Analytics, Google suite, and feedback software surveys with reporting and analytics. Just by looking at the qualitative feedback data on your screen, you can gauge whether an update or change in a strategy is working or not.

Easy as a Pie to Collect

In today’s time, when there are so many tools available online, quantitative data has become fairly easy to collect. You can use online surveys with a Likert scale such as Net Promoter Score (NPS), Customer Satisfaction (CSAT), Customer Effort Score (CES), and more. Online surveys are time-efficient and only require clicking for a few options to complete.

Easy to Identify Trends

Quantitative data makes it easier to spot trends and patterns in the collected data to understand what it means. You can track these trends on a bi-weekly, monthly, and daily basis and observe the patterns and trends in customer behavior.

The Bad

Gives No Context

One of the biggest drawbacks of quantitative data is that it does not provide context behind the numerical data. Numbers are essential in analysis but knowing the reason behind them is pivotal to understanding the data.

For example, it is crucial to know how many visitors are bouncing on certain pages, but you also need to know the reason behind the high bounce rate to fix it.

Costly to Perform

Performing quantitative research through some methods mentioned above can be costly. If you want to do in-depth research and my valuable data, it will cost a lot.

5 Ways to Collect Quantitative Feedback Data

Now that you know why quantitative feedback data is essential, let’s learn how to collect it.

Digital Analysis

Using the analytical data, you need to evaluate the components of your website. For example, your goal should be to identify the metrics you do not need to track and the critical parts of your website to focus on them instead.

An example of ineffectual metrics is ‘Time on Page.’ The time spent on a page can only be reflected when the visitor moves to another page on the website. So, the last page a visitor visits always has ‘0’ as time spent on the page.

When it comes to exploring the crucial parts of your website, it can vary from business to business. For instance, a lead generation form is an integral part of a website for SaaS businesses, but the registration and inquiry section will be crucial for an educational institution.

Similarly, the purchase action will be the most critical part of an E-commerce website, so the digital analysis will help the company distinguish the pages which are more popular among visitors than those that are not.

On further analysis, they can figure out which parts of a page grab the most attention of customers using mouse tracking to see which areas are most clicked, heatmaps to see which areas are most seen, and session recordings to see how users behave on a website.

This way, you can place important CTAs and content where it is sure to grab attention.

Technical Analysis

As the name suggests, technical analysis focuses on the technical backend aspect of your product, be it a website or a mobile app. It helps uncover intrinsic information which is not apparent.

Example

Suppose you own an e-Commerce website. While performing technical analysis for the website, you will collect quantitative data such as:

- Number of product page visitors

- Bounce rate and conversion rate for pages

- Actions are taken on CTAs, etc.

It highlights multiple issues when you start analyzing the numbers. For instance, with Google Analytics, you may discover that your landing page speed is slow to 10 seconds when it should not be more than 3 seconds. It might be because your image size is larger than it should be or may be due to many other possible reasons.

Let’s take another example.

In the above technical analysis of a website page, we can see that some countries like India, Germany, and Indonesia have the highest bounce rate of 100% than countries like the United States with 53.13%.

This quantitative data will help the company realize they need targeted campaigns to lower the bounce rate for those specific countries.

User Testing

Although this isn’t entirely new since we discussed it in the methods for collecting qualitative feedback section, the context is different here.

User testing to gather quantitative data means analyzing how much time it takes a visitor to perform a task. For example, gauging how much time it takes a customer to find a product and purchase it through the checkout process.

If you feel the checkout process needs improvement, you can record the time taken to complete the checkout on the website with the old checkout process and compare it with the new one to see the difference it made.

Causal-comparative Research

Also known as quasi-experimental research, causal-comparative research refers to a study based on comparing two different variables. It attempts to establish a cause-effect relation between the variables.

For this research, one variable is dependent on the other independent variable. It is noteworthy that the researcher only observes the variables and does not manipulate them.

Example

Suppose you want to lower the bounce rate on certain pages of your website, so you deployed an exit-intent survey.

You can A/B test and show different versions of the pages to customers, analyze the bounce rate improvement, and compare these results with the version that did not show the exit-intent survey.

Both versions of A/B testing with and without the exit-intent survey are independent variables in causal-comparative research, and a website page with a high bounce rate is a dependent variable.

*Note: Do consider both unknown and known factors which affect variables, conclusions, and final analysis.

Read More – Here is our list of 30 Best A/B Testing Tools

Survey Research

Surveys are a prevalent method to collect quantitative data effectively. They are widely used as they are easy to conduct and the respondents can be randomly chosen or specifically targeted.

Examples

You can conduct an offline survey by going to different locations and asking random people to take your survey if your research requires a broader and diverse population.

If you are a B2B business or an E-commerce business, you can use on-site and in-app online surveys to gather feedback from your customers and app users about your services and products.

You can choose to survey your customers or website visitors randomly or target a specific demographic. Tools like Qualaroo survey feedback software offer multiple features like skip logic, branching logic, analytics, and advanced targeting with which you can conduct surveys as per your need.

You can use different survey types to gather quantitative information:

Customer Satisfaction Surveys (CSATs) are great to ask about the overall customer experience. Here’s how they look –

Net promoter Score (NPS) surveys are a great way to gauge the loyalty of your customer. It uses a Likert scale, so you get the information as quantitative data

It uses a Likert scale, so you get the information as quantitative data.

User Effort Score (UES) surveys let you gauge how easy or difficult it is for users to use your product or service.

Correlational (Descriptive) Research

Contrary to causal-comparative research, correlational research does not hold the cause and effort as its basis. This observational research aims to establish relationships between variables using statistics.

It interprets and studies relations, trends, patterns in the data but does not find the cause behind them.

Like causal-comparative research, the variables are not manipulated and are only observed in their natural setting. It is why some people consider it a part of descriptive research instead of a separate one.

Qualitative vs. Quantitative Feedback Research: Creating a Balance

Qualitative research (diagnostic in nature) reveals what is happening, and quantitative research helps with funnel failures. There is no hard and fast rule to use only one; a perfect balance of both the researches brings out the best results.

There is no “qualitative vs. quantitative feedback” as both feedback types provide more meaningful insights when used together.

Examples

An NPS survey with questions like “On a scale of 1 to 10, how likely are you to recommend us to your friends?” and “Can you please explain why you gave this rating?” will collect both qualitative and quantitative feedback to take appropriate actions.

Another brilliant example of a combination of both the researches is Big Data; it has copious statistical data, but what completes it is the qualitative insights from the real people to give actual meaning to the quantitative data.

Avoid Narrative Fallacies by Restoring the Balance

Quantitative analysis allows us to back our decisions, not on speculations but on empirical facts. Even then, using only quantitative feedback data creates narrative fallacies.

For instance, if you want to switch between quantitative vs. qualitative feedback data or vice versa, you can use open-ended and closed-ended questions to collect respective insights.

When you collect the context behind the quantitative feedback, you will know the real reason behind the increased bounce rate.

You can use the two feedback data types together or switch between them as per your requirement to get the best out of them.

For instance, if you want to switch between quantitative vs. qualitative data or vice versa, you can use open-ended and closed-ended questions to collect respective insights.

To collect quantitative feedback data, use closed-ended questions like:

“Compared to our competitors, do you think our product prices are –

- Higher

- Lower

- Almost the same”

To collect qualitative feedback data, you can ask the same thing but with open-ended questions.

“What do you think about the prices of our products?”

Both the questions get you the feedback you require but in different forms.

How to Turn Qualitative Feedback into Quantitative Data

If you’ve got a couple of dozen responses coming in, it’s not that time-consuming to read them all. But if you have hundreds or thousands, it takes forever to make sense of the data you’re receiving.

The real problem with qualitative data is you can’t group it for easy synthesis. Unless, of course, you create a formula to take a deep dive into the information that the responses are giving you. The only way to process large amounts of data is to create a function to organize text like you would numbers.

Developing a program that converts qualitative responses into quantitative ones allows computers to do the heavy lifting—but only if carefully crafted.

With a tailored program that accounts for nuances in open-ended responses, you can tackle the fundamentally “human problems” involved in customer support.

1. Create an Open-Ended Survey

The first step is to develop a survey question and put it somewhere on your site where users will fill it out. Whether you’re using NPS or some other kind of open-ended survey, you’ll be able to ask a question that yields a wide range of responses.

You’ll probably get some responses that you might not expect to help you improve in ways you didn’t know possible. Human problems will yield interesting, human answers.

Here’s how you can develop your surveys in Qualaroo to get customer verbatims.

A multiple-choice question might offer a couple of different answers your team thinks about for which people are using your site. An open-ended one allows users to say whatever they want, allowing for all kinds of insights. This question, for example, might yield use-cases for your product that your team hasn’t even discovered yet.

If you’re using customer feedback best practices, you’ll yield a lot of results. Now it’s time to synthesize them without reading every single one with a fine-toothed comb.

Read More – Best Customer Feedback Tools

2. Flag Keywords in Each Verbatim

Rather than read each response individually, you can group responses into meaningful segments. That way, your team is analyzing a much smaller subset of data.

The first step is to find a way to take all this information, all these reviews, and pare it down into approachable segments with which you can do something.

Meaningful segments might include commonly mentioned categories that people bring up. For example, the word “tables” is vital to flag, but “powerful” isn’t since it’s too vague to mean anything on its own.

Here’s how Atlassian does just that. They use a tagging method to assign points for each keyword a verbatim mentions.

It divides qualitative data into categories like usability, formatting, tables, etc.—that are commonly mentioned problems.

To parse qualitative data, you need to know what you are after. By computing this electronically, you can do this at scale.

3. Quantify Keywords

There are many different ways to analyze this newly formatted data, depending on what you want to get out of it. Here are two popular ones we’ve seen.

Frequency of response: Atlassian assigns one point for every category verbatim touches on. The final analysis shows how often each one is mentioned, which allows them to see what customers are bringing up the most often.

Sentiment of response: This tells you roughly how happy the customer giving the verbatim is. Atlassian does this through NPS scores. Another way is to use a sentiment analysis API. If sentiment is negative, it will assign a poor score to the verbatim. If it’s positive, you’ll have a high score.

Once you have these quantified outcomes, you can check them against one another. Here’s what Atlassian’s looks like, which shows the correlation of categories users mention and the NPS score. It’s clear that a lot of people liked the performance, but not the tables.

It tells you which ones to read, which ones are the most important, and what’s coming up the most often, allowing you to quickly get through a lot of data.

The Right Time to Use Qualitative vs. Quantitative Analysis

We understand it can quickly become confusing to decide when to go with qualitative analysis and when to rely on quantitative analysis.

So, here are a few examples of when you should use qualitative vs. quantitative feedback analysis.

To Get General Feedback

Quantitative research can gather data from more respondents than its counterpart. It’s because surveying more respondents is more convenient than conducting interviews.

So, you can use quantitative data to answer questions like which marketing campaign was more impactful, which features/services are most popular, how you are better than your competitors, and more.

When Developing Hypotheses

You need to create hypotheses to kickstart your research. Between qualitative and quantitative analysis, the former works best here since it allows you to explore problems and opportunities to improve and confirm your understanding. You can then use quantitative data analysis to prove the hypotheses.

For example, you can create surveys with questions that procure qualitative feedback data to understand why customers disliked a product, feature, or service, how you can improve it, and why other products and services are performing better.

When You Want to Validate Your Hypothesis

As mentioned above, quantitative analysis is your best option to validate your hypotheses since it has all the statistics.

Since you used qualitative data to create those assumptions and confirm your understanding, you now need reliable feedback data to see if those assumptions uphold or not.

Carrying forward the example from above, you can create surveys with questions that generate quantitative feedback data, which is more stable and objective so you can base your business decisions on it.

Adding the Human Touch to Your Analysis

When you are at the end of your research, you need the qualitative feedback data as a chef’s kiss to make your research wholesome. You can add qualitative data from open-ended questions as quotations backing your quantitative insights to add a human touch to the cold numbers instantly.

Conducting Market Research

Market research and user research is an indispensable practice for all industries and businesses. When you launch a new product, feature, or service, you can conduct it according to your products, services, and users.

It helps analyze the validity and demand of your idea. Qualitative and quantitative analyses are pivotal for market research as both provide wholesome results. The whole process looks like this-

Questions to Ask in Qualitative and Quantitative Research

Now that you know qualitative and quantitative research beyond the tip of the iceberg, you should know the questions you need to ask to get both qualitative and quantitative feedback.

Examples of Qualitative Feedback Survey Questions

How can we improve your experience?

- Please describe the last time you purchased an item online.

- Why did you choose [Option A] to complete [Option B]?

What do you like most about your favorite [Your option]?

What do you think your favorite [Your option] can improve?

- What kind of content would you like to see from us?

- How would you explain your onboarding experience?

- Is there anything missing from our [Product/service]?

Examples of Quantitative Feedback Survey Questions

There are many question types you can use to collect quantitative data. You can use checkboxes, radio buttons, Likert scale, drop-down menu, Slider scale, rating, Image select, NPS, and more.

The questions generally look for the answer to how many, what, and when.

- How many times per month do you purchase [Your option]?

- On a scale of 0-10, how likely are you to recommend our [product/service]?

How often do you [Your option]?

If applicable, which [Your option] do you prefer?

How would you rate the delivery service?

When was the last time you [Your option]?

- What do you think about this statement: “Global warming is real and causing the recent unanticipated changes in the climate. We need to take swift actions while we have the chance.”

- How would you rate your stay at our hotel?

- The customer support made it easy for me to resolve my issue.

- Which of the following are most important to you while ordering food online?

Related Read – How to Write Good Customer Questions

Use Both Qualitative & Quantitative Feedback for Best Results

With an in-depth understanding of your business and through this blog, you’ll be able to discern when to perform qualitative vs. quantitative feedback research and when to strike a balance between the two.

Collecting the right insights is the way to improve specific customer interactions and overall brand experience.

The best way to starts is with a quantitative user research question. Then, guide your users toward more in-depth qualitative questions to explore niche data points.

You can even use branching to show relevant questions to users based on their answers.

So, use the focused strategies to employ the right qualitative and quantitative research analysis methods and unravel the hidden insights your business needs.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!