Many people, including some professional researchers, use the words survey and questionnaire synonymously. But, there is a difference between survey vs. questionnaire.

In some cases, using these two words interchangeably isn’t a big deal because the context usually clears things up.

However, in other cases, a slight mishap can impact the message. That’s why researchers, managers, and marketers need to have clarity when talking about surveys and questionnaires.

In this article, we dig deeper into the question “Are surveys and questionnaires the same thing?” and understand how and when to use each one.

Why Should You Understand The Differences?

No matter how subtle the difference between a survey vs. a questionnaire in research may be, it is crucial when conducting your research.

Both surveys and questionnaires have different applications and uses. If you want to make your user research (or any research) a success, you should know when and for what each one is used.

For that, let’s get down to the business.

What Are Surveys?

In simple words, a survey uses a set of questions to collect data for statistical analysis.

Surveys gather data used for forecasting. Unlike the questionnaire, survey data is analyzed as a whole. Surveys consider all the responses to conclude the results. They also help find trends and behavior that allows companies to look at the big picture.

Surveys amalgamate methodologies, processes, questionnaires, and metrics in a broader sense. They collect insights from different people to analyze the data, draw conclusions, and test hypotheses.

For example, a set of questions is a questionnaire versus a survey that includes everything from collecting the data to organizing and analyzing it.

Compared to offline surveys, which were costly and tedious to analyze, online surveys are leaps and bounds ahead.

Businesses from all spheres use online surveys to gauge their customers’ satisfaction and experience.

Example of a Survey

Suppose you conduct a survey gauging customers’ experience with a newly launched feature in your existing product.

You send a questionnaire with appropriate questions to collect their input, such as the pros and cons of the feature, its effectiveness, and performance.

Each response on its own won’t help the company understand the overall success of the feature since each experience will be slightly different.

But once you organize the data from the questionnaire and analyze it using data visualization techniques, the results will be precise and clear.

You’ll know many customers approve of the feature and how many customers are unsatisfied and need a follow-up so they won’t churn away.

Types of Surveys

There are many types of surveys that businesses use to measure their KPIs. They are:

Net Promoter Score Surveys

NPS surveys are used to gauge the Net Promoter Score of any company by asking a simple question on a Likert scale of 1 to 10. The NPS survey metric helps distinguish your detractors from your promoters.

You can follow up on your detractors to resolve their issues and reward your promoters for keeping them loyal to your company. In doing so, you are improving the customer experience of both types of customers.

Example: “On a scale of 1 to 10, how likely are you to recommend [Product/Company] to your family and friends?”

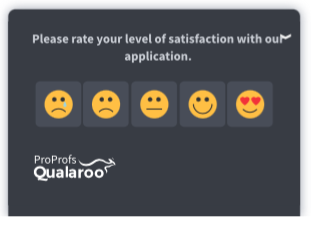

Customer Satisfaction Surveys

CSAT surveys are used to understand the specific and overall experience of the customers. For example, you can ask customers about their satisfaction with a specific product, feature, or service and their overall experience with the brand.

Example:

- Which of the following words would you use to describe our product/service?

- Useful

- Reliable

- Overpriced

- Impractical

- Unique

- Poor quality

- How well does our product/service/application meet your expectations?

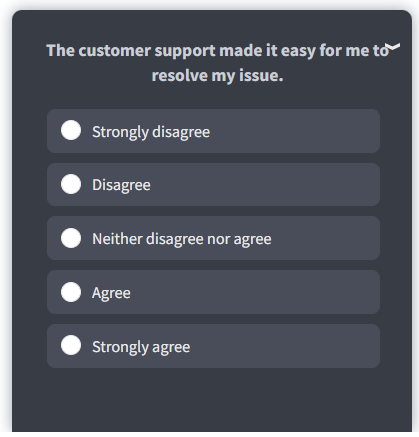

Customer Effort Score Surveys

CES surveys are used by businesses to understand how easy or difficult it is for their customers to achieve a goal with their product/service. The higher the score, the better.

Example: How easy is our product/website to use, in your opinion?

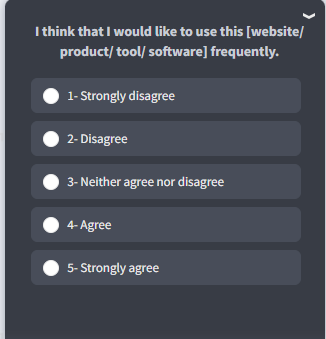

System Usability Scale Surveys

System Usability Scale surveys are helpful when you want to understand how easy or difficult it is to use your product/application for the users.

Example: I think I would like to use this [website/product/tool/software] frequently.

Exit-Intent Surveys

Exit-intent surveys ask visitors what they are looking for when they are about to leave your website. These surveys are great for reducing the customer churn rate since you can help customers with their issues and queries and stop them from leaving your website.

Example: “What stopped you from purchasing today?”

CASE STUDY: BELRON

Belron has two brands offering the same automobile windshield services in the US (Safelite) and the UK (Autoglass).

Belron also faced a high bounce rate on its website, which was a concern since its users are one-time customers who need to fix their broken windshields. So, why would they leave without fixing the problem?

With Qualaroo, Belron leveraged exit-intent surveys to ask leaving customers what was missing from the website and how can the company help them.

In the words of Jamie Carter, Voice of the Customer Manager, “The only way that we can continually provide [the easiest possible] experience is by understanding and internalizing what previous customers have told us.”

So, after collecting feedback from customers, Belron found a new user persona they never knew existed. With this discovery, the company created better strategies to target the new user persona and lower the bounce rate.

What is a Questionnaire?

A survey questionnaire is a part of a broader survey and is used for collecting information about individuals from a list of selected questions. It is limited in its scope and doesn’t analyze statistics or paint the bigger picture.

As a business, a survey questionnaire is something you’d send a customer to understand their specific experience and not your collective customer experience; that’s a job for surveys.

Questionnaires collect the data from the target audience with multiple questions such as open-ended, closed-ended, ratings, Likert scale, and more. They also help in collecting qualitative and quantitative data for research.

Example of a Questionnaire

Suppose a company wants to offer its employees health insurance. They would require information about each team member to analyze their needs. The company sends a questionnaire with different questions to collect the employee data.

In this case, each questionnaire will be examined on its own since it offers data only about one employee. The data collected will not be analyzed as a whole.

Types of Questionnaires

You can choose from a variety of questionnaires for your survey. It depends on your purpose and what kind of data you want to collect. Let’s have a look at them.

Pictorial Questionnaires

As the name suggests, Pictorial questionnaires consist of images more than text. They are used for advertising and branding purposes by companies, among other things.

For example, a company may send out a pictorial questionnaire to ask its employees to choose a preferred logo. They are used to increase engagement in surveys as they are more interactive.

Quantitative Questionnaires

These questionnaires consist of closed-ended questions with predefined answer options. Quantitative questionnaires use the Likert scale including NPS, CES, and CSAT questionnaires. Scaled questionnaires are mainly used for quantitative research since these effectively collect quantitative data.

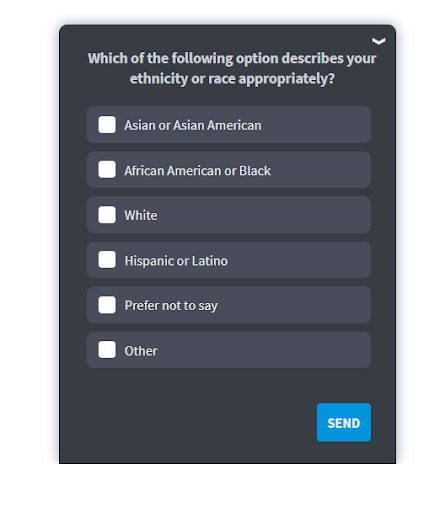

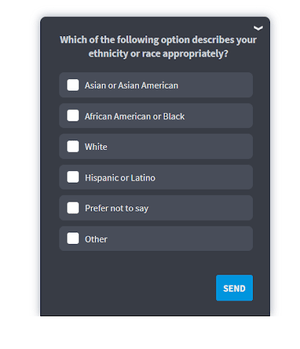

Demographic Questionnaires

Demographic questionnaires are closed-ended questionnaires that aim to collect data from a target audience on age, religion, ethnicity, income, sex, and much more. These questionnaires help companies define their target user personas and explore more about their employees.

Psychographic Questionnaires

Psychographic questionnaires collect ‘soft’ data about a target audience for research.

They gauge a target audience’s personality, preferences, attitudes, and values. These questionnaires are perfect for defining user personas.

For example, eCommerce companies can use this questionnaire and ask open-ended questions to dig deep into customers’ preferences and shopping habits.

Qualitative Questionnaires

Qualitative questionnaires consist of open-ended questions which allow respondents to share their feedback freely in their own words. These are great for collecting contextual feedback that aids your quantitative research.

Since this questionnaire collects written responses, manually analyzing the data can be a hassle. For this, companies use tools like Qualaroo feedback software that collects data from customers through surveys and helps analyze the data from the qualitative questionnaires.

It comes with a sentiment analysis feature powered by IBM Watson that analyzes the written responses using Artificial Intelligence and highlights the most-used words in the feedback.

It also assigns an emotional score to the feedback data that gives an idea to businesses about how their customers feel towards them.

[Related read: How to Use Qualitative Data to Improve Your Blog]

What are the Differences Between a Survey and a Questionnaire?

The main difference between a questionnaire and a survey is that a questionnaire is a written set of questions and refers to content. In contrast, the term survey is broader and encompasses content, the method of delivery for the questionnaire, and analysis of the responses.

Here’s a comparison table of survey vs. questionnaire in research to clarify things further for you.

| Parameters | Survey | Questionnaire |

|---|---|---|

| Difference | Known as the process of gathering and analyzing research data | Known as a tool for collecting research data |

| Types of questions | Both open-ended and closed-ended questions are asked | Closed-ended questions are asked |

| Time spent | Time-consuming | Collects responses quickly |

| Use | Deployed for a target audience | Distributed among the respondents |

| Type of answers | Subjective and objective | Objective |

| Analysis of response data | Yes | Only records responses |

| Depth of questions | Multiple subjects | Multiple subjects |

| Use of skip and branching logic | Indirectly helps surveys to collect responses from the specific audience and filter out unsuitable participants | Allows respondents to skip questions in a questionnaire or redirect them to a different questionnaire as per their responses |

| Deployment | Can be conducted on websites, mobile apps, and prototypes to collect and analyze customer feedback | Can be sent offline or through email, URL link, and SMS to individual respondents |

So now you understand the distinction between the words questionnaire vs. survey and that the two terms cannot be used interchangeably.

Now, let’s take a look at when you should use a survey as opposed to a questionnaire.

When to Use Survey vs. Questionnaire

There are times when a business benefits the most from using online surveys and other times when they would benefit most from questionnaires. So, here are some examples of when to use a survey vs. a questionnaire and why.

When to Use a Survey:

A survey is a better option than a questionnaire if you want feedback from respondents. A survey allows you to aggregate data from multiple survey participants to make general conclusions about your results.

Example of a Survey: In a sense, a survey is a questionnaire, but the way it is designed, implemented, and analyzed impacts the survey results as much as the questions do.

Take the customer satisfaction survey (online, email, or paper) as an example that a business uses to get actionable feedback from their clients so they can provide better service.

When to Use a Questionnaire:

Standalone questionnaires don’t have a great many use cases. You can use them to build your email list, collect personal accounts for research projects, or accept donations or payments.

Example of a Questionnaire: When you last visited the doctor, you were likely asked to fill in a form with specific questions about your medical history. That is an example of a questionnaire.

The doctor used the information you provided to assess risk, diagnose, and get a picture of your medical history. They didn’t use it to look for behavior, trends, or a bigger picture.

5 Common Mistakes When Writing Surveys and Questionnaires

Although most researchers and marketers can create an effective survey, sometimes minor issues can find their way into the questionnaire and compromise the quality of the survey, resulting in misleading results.

Below are five common mistakes you should avoid when writing surveys or questionnaires.

1. Writing Leading Questions

Leading the respondent is among the most common survey mistakes. The issue arises when adjectives are used to sway the reader to either side of the argument.

It is a common problem because organizations usually spend time creating user personas, and then try to write the questions with those people in mind.

Leading questions include non-neutral wording, and tend to inflate ratings in various aspects like product research and customer satisfaction when used in market research surveys.

Example of a leading question: “How likely are you to purchase our newly designed, top-of-the-range smart speaker?”

The problem with this question is the use of the adjectives “newly designed” and “top-of-the-range,” which can cause bias.

A better option would be to use those words in the product or concept descriptions but not in the survey question itself.

Another example of a leading survey question that can ruin your data is a question such as: “How has the Coronavirus negatively impacted businesses?“

A better question would be: “How would you describe the impact of the Coronavirus on businesses?“

2. Using Jargon or Unclear Acronyms

Another mistake that survey creators make is using industry jargon or acronyms that respondents may not understand.

Vague language can hurt the quality of replies and render your results inaccurate. You must speak your respondents’ language to ensure that you don’t confuse anyone taking part in your survey. Also, make sure your grammar is perfect and the way you convey the message is clear.

The easier it is to answer your questions, the more likely respondents will complete your survey. So, do your best to avoid tricky concepts, technical jargon, and complicated language.

If you have to include any uncommon terms, always provide definitions and examples to simplify things for your readers.

Example of an unclear question: “What was the state of the audio of the call?”

Example of a clear question: “How would you describe the call?“

As you can see from the examples above, the same question can be asked in a much simpler and straightforward way, making it more likely for everyone to answer the questions easily.

3. Making Your Survey Too Long

People’s attention spans are very short these days, and participants usually don’t want to spend more than a few minutes answering questions.

If your survey has more than a few questions, there’s a chance that you will lose your readers’ initial commitment to complete the survey. Your respondents will either leave the survey unfinished or give random answers to get it over with.

That’s why it’s essential to choose quality questions rather than a huge quantity to gather the information you need. For example, customer satisfaction is usually measured with Net Promoter Score (NPS), simply a one-question survey.

Do your best to keep your survey as short and precise as possible. Research shows that over 72% of survey respondents want to spend only 6-10 minutes on a survey.

The more questions in the survey, the higher the response times. It makes customers less likely to complete the survey.

A good rule of thumb is to use fewer than 10 questions, but if necessary, you can push it up to 15. Try not to go upward of this number as there will be a higher likelihood that your respondents will abandon your survey before they get to the end.

4. Overlapping or Unclear Response Options

Yet another mistake that you should avoid when creating surveys is adding wrong answer options.

For the most part, response choices should be definitive and mutually exclusive. If there is any ambiguity, it will confuse or frustrate your survey respondents.

For instance, if you have a survey that asks your customers how many years they have been a customer, you may give them the following options:

- 1 – 2

- 2 – 5

- 5 – 10

The problem with this is that the options don’t take into account those who have been customers for less than a year and those who have been with your business for over 10 years.

Also, because of the overlap of time, you will potentially get different answers from those who have been customers for precisely 2 or 5 years. It will result in inaccurate and misleading results.

To avoid this issue, you can add more granularity to your options. Alternatively, you can use number fill-ins whenever appropriate.

Vague and Open-Ended Questions

Last on our list of survey mistakes to avoid is the use of vague and open-ended questions. They can lead to respondents misinterpreting what information you are looking for.

If your respondents have to guess what response your studies favor, that amounts to a wasted opportunity.

A vague question like “How can we improve our service?” may result in many respondents taking the question in an unintended direction. Likewise, open-ended questions could result in inaccurate results due to several factors, such as:

- Faster respondent fatigue

- Higher dropout rates

- Less consideration given to questions

Open-ended questions can be revealing, and while it may be necessary to include some in your survey, it’s important not to include too many of them as this may ultimately compromise the quality of your data.

You can refer to our detailed blog If you need to dig deep into what types of survey errors people make. Once you know what they are, you’ll be able to avoid them while creating your own questionnaires and conducting surveys.

Use Questionnaires & Surveys The Right Way!

Now that you know the answer to “Is a questionnaire the same as a survey?” you’ll never mix them again.

Correct usage of these tools can lead to increased revenue for your blog or business overall, and it’s important to remember the lessons learned within this article to do so.

To give you a quick recap of survey vs. questionnaire, a questionnaire is a list of written questions that allows you to collect data for one purpose, while a survey includes the questions, as well as the method and analysis to glean statistical data and make forecasts.

You can use surveys or questionnaires on various social media platforms to get to know your audience in a better way. For best results on social media, you can also use tools like Twitter marketing tools, LinkedIn marketing tools, etc.

Armed with this information, you can now make the best choice for your business and begin gathering information to help you make sound decisions for your future marketing endeavors.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!