What’s one of the biggest nightmares for any business? Leaving customers, AKA customer churn or customer attrition. It’s the one boogeyman that’s sure to drive anyone sleepless.

Who wants to see their hard-earned customer base shrink, right?

But the reality is you can’t avoid it irrespective of the preventive measures in place. The trick is to reduce it to a minimum and find the right customers to retain.

You have to strike the right balance between acquiring and retaining customers to prevent the acquisition costs from outpacing the ROI. After all, retaining customers also cost resources and money.

And that’s what we have for you in the store today. We have listed some practical ways to reduce customer churn in your business. We will also outline the tactics to predict the customer’s churn probability so they don’t slip out of your hand unnoticed.

What is Customer Churn?

Customer churn is the number of customers that walk out of the door in a given period. It includes customers who moved over to the competition and the ones who terminated the services or stopped purchasing the product from you.

In its simplest form, customer churn rate is the percentage of people that stopped doing business with you during a given period.

Customer churn = [ (customers at the start of the period + newly acquired customers – customers at the end of the period) / total customers during that period ] x 100

Customer churn, when uncontrolled, is a serious problem for a business. To give you an idea about its impact on your business, let’s crunch some numbers.

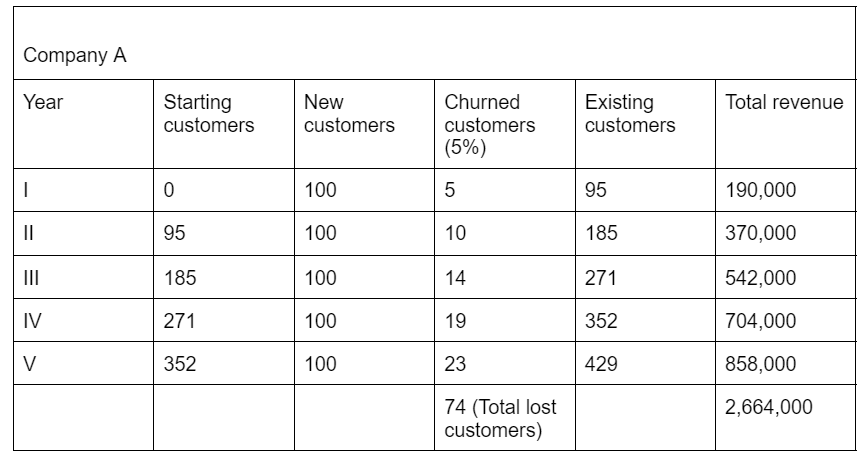

Say there are two companies that acquire the same number of customers per year and earn an average of $2000 per customer. But the churn rate of company A is 5%, and that of company B is 15%.

Let’s see how they fare after five years:

We can clearly see that:

- In five years, company B earned over 27% less than its competitor, Company A. This amount equates to $576,000.

- In the 5th year, the difference between the annual revenues of the two companies was a staggering 58%.

- When we talk about the difference in customer base, company B lost double the customers than company A which is not good for brand image.

In the above example, we averaged all the customer types to calculate the revenue. What if you were to estimate the effect of churn using only high-value customer segments? The loss would be even higher for both companies.

Pretty scary scenario indeed!

That’s why you have to understand why this happens and how to deal with it.

Types of Customer Churn & Their Causes

If you want to reduce unnecessary churn, you first need to spot it and find out its cause. Only then can you implement the measures to retain the customer before they hit the road.

So, there are primarily two types of churn behavior that can stem from your end or the customer’s side.

Voluntary Customer Churn

Voluntary churn is when the customer decides to terminate the services on purpose. Businesses need to keep a sharp eye for this type of churn as it might be due to serious product issues or problems with your support services.

As to what causes this behavior, multiple factors can contribute to it:

Change in Prices

It can make a product unaffordable for some customers prompting them to look for alternatives. Run a pricing analysis before changing your pricing structure. You can add a small survey on your website or app to gauge customer preference and how they perceive your current pricing tiers.

Business Shutdown

This one is pretty much out of control, and you cannot do anything about it.

Unsatisfactory Services & Support

If your customers face constant product issues and their grievances are not addressed on time, they are bound to look for better shores.

Better Value for Money Offered by the Competition

People are always looking for better services, prices, and product value. If your competition has a better product offering, you will lose even your loyal customers in the long run. That’s why it is necessary to run a competition analysis to stay ahead in the race.

Targeting different customer types with small market research surveys can go a long way in establishing customers’ purchase preferences and expectations of your brand. You can then look into your competitors to deliver a better experience.

Change in Product Requirements or Business Model

This situation is also out of your hands. In this case, the only way to stop churn is to analyze the customer’s new requirements and see if your product solution fits their model.

Lack of Product Updates or New Features

Innovation is the key to increasing customer engagement and retention in today’s world. If your product is not evolving with technological advancements, you may lose your customers to competitors offering new and improved features to make work easier.

Involuntary Customer Churn

Involuntary churn is when a customer cancels their services or subscription due to an unforeseeable situation or incident. Payment issues are one of the primary reasons for involuntary churn, especially for a subscription-based pricing model.

Some of these instances include:

- Payment failures due to card declination

- Issues at checkout

- Failure to update payment information

- Loss of customer account or card

All these factors represent a loss of a customer who was willing to provide you revenue. The good news is, involuntary customer churn is easily avoidable using simple measures:

- To monitor such behavior, you can set triggers that remind customers about their upcoming payments.

- Encourage them to set up auto-payment in their account to prevent subscription cancellation.

- Deliver automatic notifications about payment failures to customers via email and SMS and remind them to update the card information to avoid service cancellation.

- Set an alert at your end whenever a service is canceled due to payment failure so you can quickly follow up and take necessary actions to prevent customer churn.

Importance of Monitoring Customer Churn in Business

Curbing customer churn promotes higher customer retention, which means higher lifetime value and more revenue.

When you see that companies lose over $136 billion every year in the U.S. alone due to customers switching leaving the business, it becomes evident that you need to monitor the customer churn.

Customer attribution analysis helps plug the unwanted revenue leaks among your customer base, which can be voluntary or involuntary. You can predict the probability of customers’ churn based on their behavior and prevent it before it’s too late.

For example:

- It helps to identify the customers with a high risk of churn. And if you are analyzing high-value assets, it can help you retain a customer with a potential for more than average purchase value and long-term loyalty.

- If an average customer carries a churn risk, You can evaluate if you have recovered the acquisition cost from them or not. Plus, you can analyze if the retention of such customers adds unnecessary costs to your business and develop a sound strategy for the future.

- If you have a subscription-based revenue structure, you can estimate the recurring revenue for the next year based on the past and current churn trends. It can help you to plan your budget accordingly.

Disadvantages of Customer Churn

Uncontrolled customer churn in business is bad for your revenue stream, damaging your brand image and customer relations.

Let’s see what else leaving customers take away from you:

1. Reduced Monthly or Annually Recurring Revenue

Lost customers equal lost revenue.

If you offer SaaS-based product solutions, a higher churn rate will hurt your recurring revenue. You may acquire more customers with time, but a significant portion of the potential revenue is lost that could have been earned had the customers not left.

We saw this when we calculated the revenues for our hypothetical companies A and B.

By the time you read this, company B has gone through severe budget cuts. We feel bad for it, but it didn’t take the hint for five straight years.

2. Lower Customer Lifetime Value

Churn affects every customer segment, and when it creeps up to your regulars and high-value assets, it leads to a shorter customer lifespan with the brand and reduced lifetime value. If customers leave before generating profits, it would also increase your overall acquisition costs.

3. Shrinking Customer Base

Looking back to our hypothetical example, company B lost twice as many customers as company A. In a competitive environment, it means your competition’s customer base is growing at a much faster rate than you.

What’s more, it can create a bad brand image and negative word of mouth.

4. Added Win-Back Expenses

When customers cancel their services, you need to employ additional resources to win them back. This cost adds to your acquisition costs, making the situation worse.

And if you are offering a discount to retain customers without adequately understanding the reasons behind the churn, you may end up losing those customers anyway. These uninformed campaigns produce almost zero ROI for the company.

How to Predict Customer Churn in Business?

Prevention is better than cure. Don’t wait till the end. Learn to study your customer’s intent and behavior to catch them in the churn act.

Except for one-time shoppers or low-value customers, a large percentage of your regulars won’t simply turn their back on you instantly. They change purchase frequency, account usage, or lower the purchase amount if they start to feel unsatisfied with your products and services.

And you can track these behavioral cues to predict the probability of churn and act on it to prevent customer attribution.

Here are a few ways to approach this problem:

1.Using Customer Experience(CX) Score

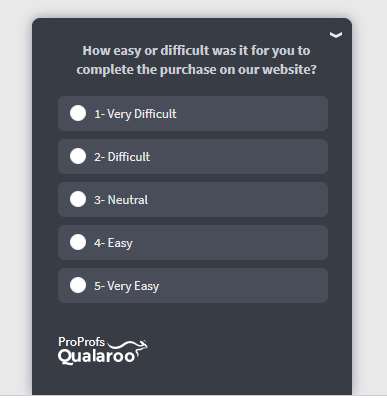

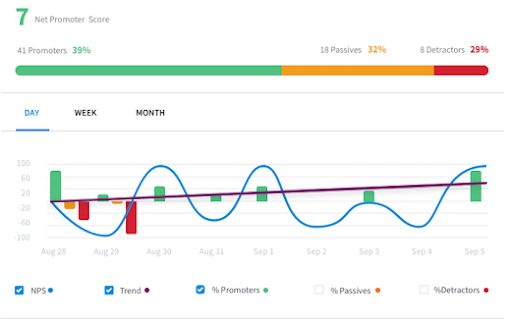

When we say CX score, we mean tracking metrics like NPS, CSAT, and CES. It is one of the most effective ways to predict customer churn probability. You get data points directly from the customer to understand their current perception of your brand.

It is pretty simple too.

Want to see how it’s done in real life? We have the perfect example for you.

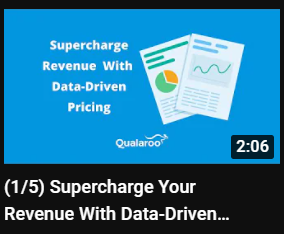

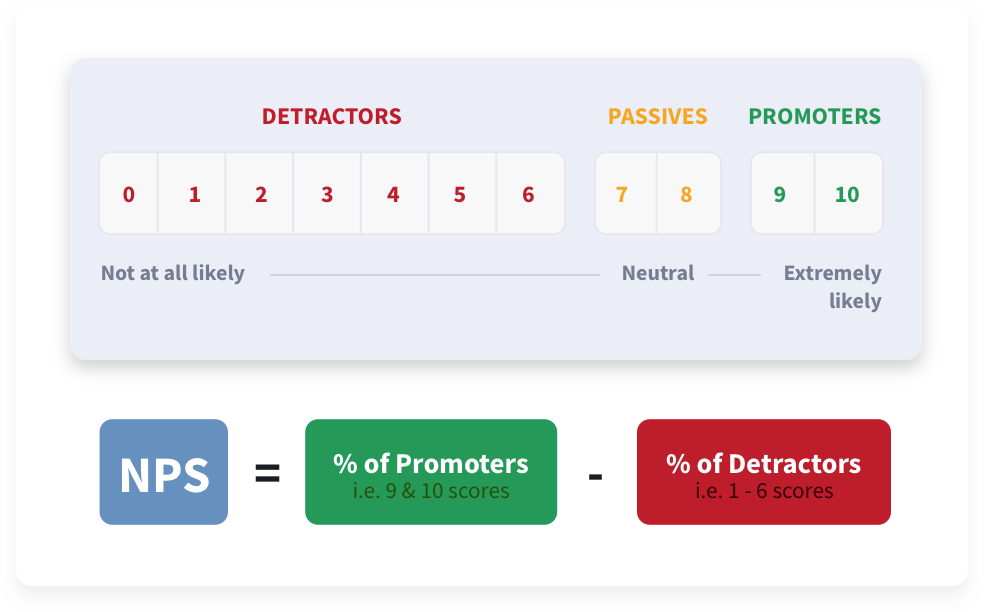

MonetizeCX developed a CX score (NPS) vs. spend matrix to identify the churn probability and revenue potential for different customer segments.

How did they predict churn with NPS score?

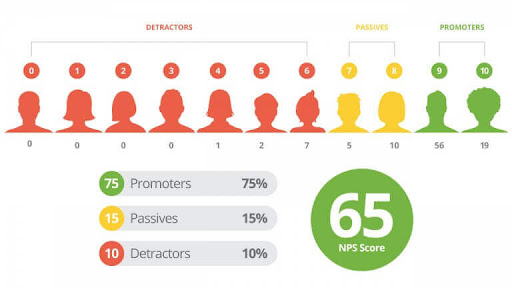

The NPS survey is scored on a scale of 0-10, and respondents are divided into three groups:

- Detractors (0-6)

- Passives (7-8)

- Promoters (9-10)

The team observed the customers with above-average spending who scored low on the NPS scale (0-6). These represented 20% of the total customers

These high-spending customers carried a high risk of churn as they were unsatisfied with the brand. So, it was decided to address their pain points and issues to retain them.

But no action was taken to retain detracting customers with below-average spending as it would add unnecessary acquisition and retention costs.

The results:

- A 20% boost in the NPS score in a few weeks means an increase in loyalty.

- A 4% increase in the customer lifetime value of high-spending detracting customers, indicating improvements in retention rate.

So you see, a simple NPS survey combined with the customer’s purchase value can help in customer churn analysis.

In the same way, you can keep an eye on other metrics like CSAT and CES for different customer segments to predict their behavior and churn probability.

And the best part is, simple targeted CX surveys also let you collect more in-depth information about your customers’ preferences, pain points, and issues so you can resolve them in time.

Here’s how:

- Add simple follow-up questions to your CX surveys to explore the reasons behind their previous answers.

- Once you have the CX scores and other feedback data, you can combine these data points with different customer tiers to visualize which group has the highest probability of attrition and requires immediate attention.

- Then, feed these findings to different teams to plan the next course of action to retain the customers.

If you’re having trouble getting started, numerous survey tools are available with pre-built survey templates and question repositories.

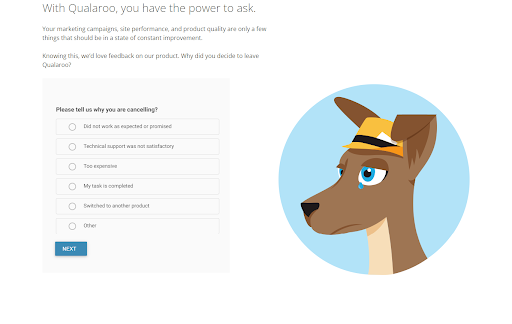

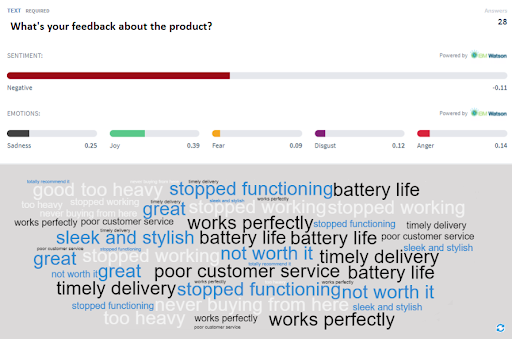

Advanced tools like Qualaroo also provide in-depth targeting options to ask the right questions to the right audience at the right time based on their behavior and actions. Plus, advanced techniques like sentiment analysis can help make feedback analysis faster.

With Customer Data

Use your internal data. If you have 100 good customers, what is their profile? Who are they, where are they from? What are they doing, and What is their LTV? How can you find more people like these?

– Justin Wu, CEO at Growth.ly

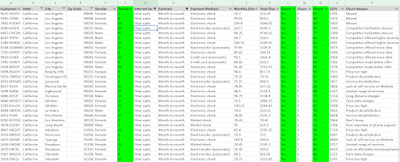

Another important tracking mechanism is your internal customer data. With the help of a robust CRM like BIGContacts, you can see customers’ activity trends with time and spot any changes that may indicate the possibility of churn.

That’s what we do at ProProfs to prevent and analyze churn for our high-value customers:

- Our marketing team receives auto-alerts in the CRM about customer activity, such as status change, inactivity in the last 30-45 days, account cancellation, and more.

- The team then dives into the customer data using our CRM to study the customer’s behavior and scan their account activity logs like last login date, last payment, number of surveys created, current users, and more.

- The next step is to get in touch with the customer and convince them to reactivate the account.

- We also display the cancellation survey when a customer cancels the subscription to collect more information about their decision.

With Advanced Techniques Like M/C Learning

If you have a large customer base, it would be uneconomical to track each customer’s behavior manually. That’s where AI-based predictive algorithms come in handy.

Today, companies are putting resources into building and implementing frameworks that work on machine learning to analyze customer actions and highlight customers with high churn automatically.

But you don’t have to lock your developers in the basement to have a customer churn analysis system in place.

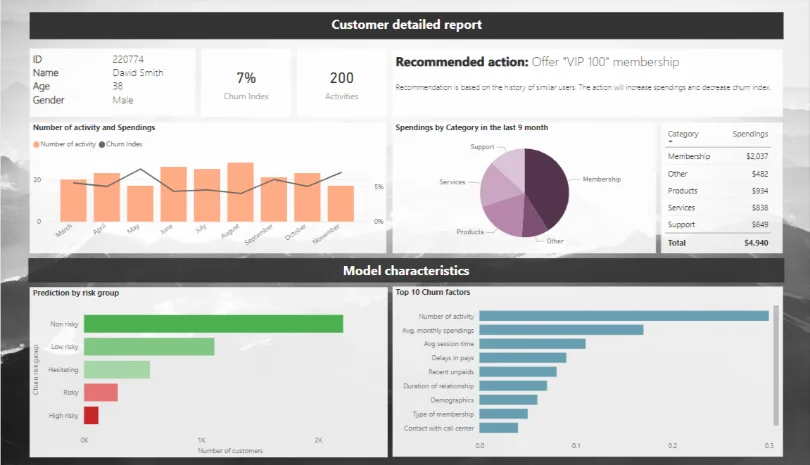

Several tools in the market provide inbuilt AI-churn analytics to make your job easier. Here is an example of IBM’s Cognos Analytics engine that automatically tracks customer churn based on multiple factors.

The most significant advantage of ML-based churn analysis is that it can shift the focus from identifying high-risk customers to putting effort into stopping them from leaving, saving both time and resources.

12 Practical Tips to Reduce Customer Churn in 2023

Now we’ll be diving into the most crucial part of this entire exercise – reducing customer churn.

Customer attrition happens along multiple stages of the customer journey:

- Product adoption stage

When the customer tries the product or starts to use it. Here successful onboarding and efficient customer support can make a huge difference.

- Product usage stage

When the customer experiences problems or issues while using the product. To combat this churn, you need to listen to their pain points and issues and resolve them quickly.

- Drop-off stage

When the customer finds a better alternative or when the tool is no longer helpful. Regular product updates and new features can help fight this type of churn.

Let’s now look at some of the measures that can help you improve your churn rate at each stage:

Benchmark Your Numbers

Feeling confused about how to begin? Start by evaluating where you stand. It’s almost impossible to stop churn, so setting a benchmark for your goals is an excellent way to get things straight.

It gives you an idea about where you stand compared to your industry standards and helps to set realistic goals.

Here’s how to do it:

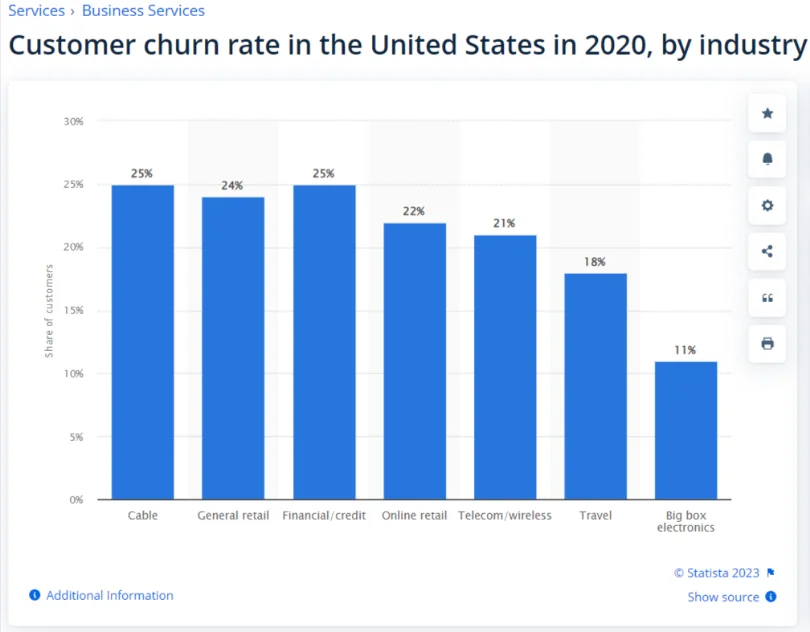

- Look at the industry standards. For example, the average churn rate for different industries in 2020 looked like this:

- Now, depending on the type of industry, you can compare your churn rate and allocate resources to bring it down.

- If you are already doing better, you don’t need to make excessive changes saving both your time and effort.

- In this case, you can explore more niche strategies like those mentioned below to reduce customer churn further.

- You can also create your own benchmark by running customer churn prediction analysis from previous years’ data and visualizing the general trend.

Leverage Churn Rate Analysis Software

The next step is to get the house in order. Start by looking for good customer churn analysis software based on your budget and resources. Periodic analysis and vigilance let you map customers’ behavior over time and predict the reasons for customer churn.

Some tools, like Microsoft BI, also offer recommended actions based on the reports, as shown in the image below:

Suppose you can’t get a machine learning-based model in your business. In that case, you can always use your inbuilt CRM and voice of customer tools to identify customer attrition and take appropriate actions.

Regularly Monitor Customer Experience Index

Customer or user churn, mainly when voluntary, is often a result of customers’ poor experience with your brand. Product Bugs, issues with the product, unheard complaints, poor services, and other such experiences are the stimuli for customers to leave the brand.

In fact, 69% of people switch brands because of poor customer experience.

That’s huge!

So, it makes sense to track the customer experience index(CXI) to gauge customer engagement and loyalty towards your brand.

Here are some ways to do it:

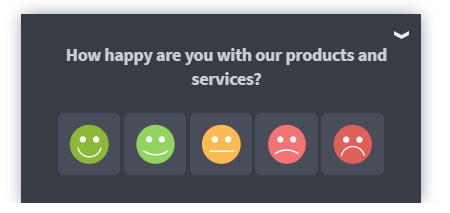

- Collect Net promoter survey (NPS) scores through on-site and email surveys to track long-term customer loyalty.

- Run Customer Satisfaction Surveys (CSAT) to find out how happy customers are with your products and services.

- You can also design Customer Effort Surveys (CES) to measure the effectiveness of your customer support services and pinpoint issues that may lead to customer churn. CES is also a great indicator of customer loyalty.

- Use surveys at various customer journey stages to track changes in CX scores with time.

- Follow up with customers who fill out your surveys to see if their issues have been resolved or not.

- Track usage data of high-value customers like last order date, last login, etc., to catch any dormant activity.

- If the usage has declined with time, send a survey to discover any possible issues.

Personalize the Customer Experience

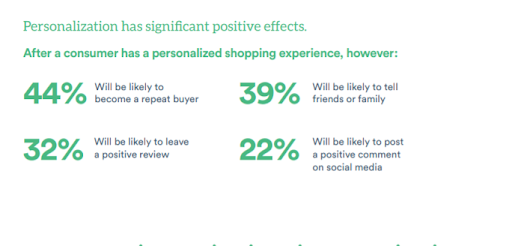

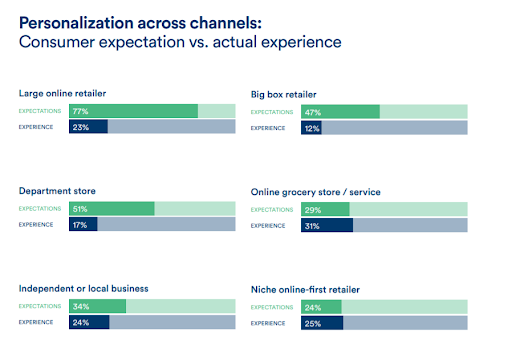

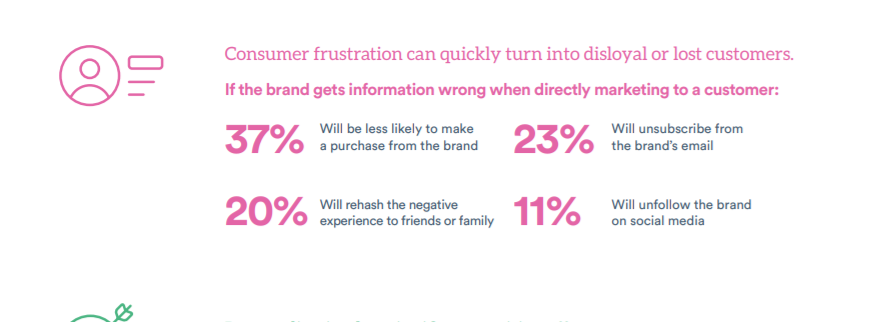

Experience personalization can drive higher purchase values, customer retention, loyalty, and even brand promotion. On the other hand, a generic experience – online or in-store can lead to customer frustration and possible customer churn.

But a huge gap exists between what businesses think of personalized experiences and customers’ expectations.

So, you might be delivering an unsatisfactory experience without even realizing it. And the frustration can quickly lead to customer churn.

Here are some simple fixes to deliver a personalized experience and reduce churn:

- Segment your users to create personas that define their tastes, shopping behavior, frequency, lifestyle, and preferences.

- Install survey tools like Qualaroo on your website or mobile app to map customers’ issues, likes, and dislikes to personalize their experience.

- Use advanced experience personalization software like Yieldify that automatically tracks customer actions and behavior to suggest experience personalization options.

- Streaming services like Netflix offer recommended programs based on viewers’ watch history to combat user churn.

- Social media platforms like Facebook and Instagram show relevant posts based on your engagement and clicks.

- Online retail brands send emails and SMS notifications about discounted prices of the products you purchased in the past to entice you into ordering them at a lower price.

Close the Feedback Loop Quickly

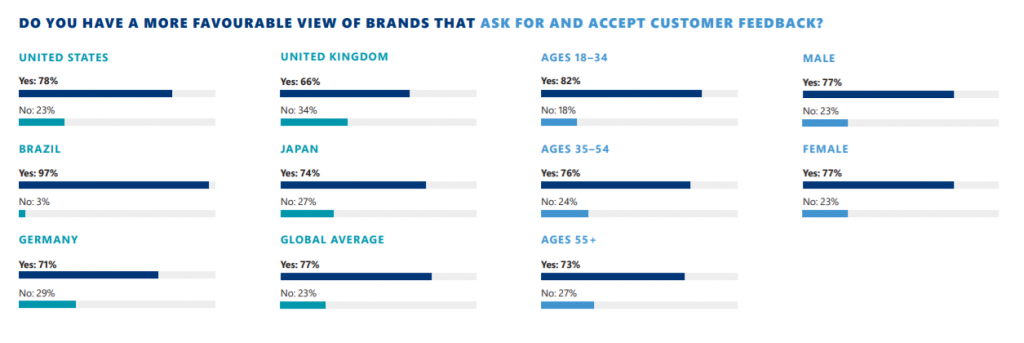

In the last point, we mentioned the importance of the VOC surveys or feedback management system because over 78% of customers favor brands that regularly ask for and accept customer feedback.

Even if you are collecting customer feedback, are you addressing it promptly? Over 58% of people feel that their feedback goes unheard by brands.

How long before such a customer gets frustrated with your services and switches the brand?

So, it’s all for nothing if you cannot close the feedback loop quickly.

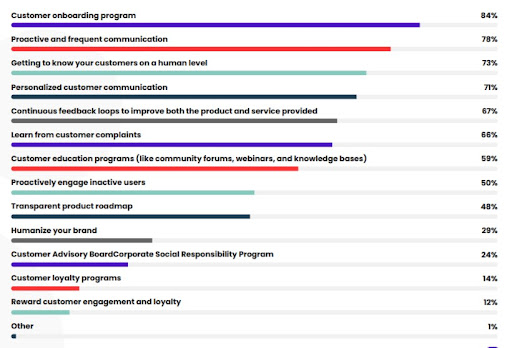

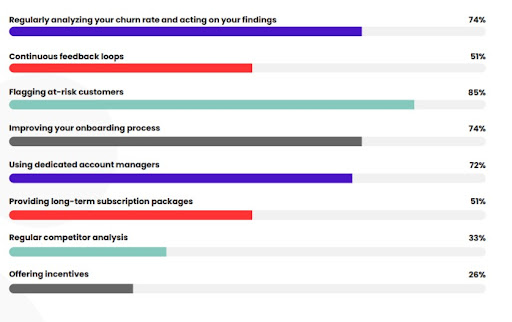

According to a 2021 study by FutureofSaas, closing the customer feedback loop is businesses’ second most used strategy to combat customer churn.

Here are some ways to close the feedback quickly to reduce customer attrition in your business:

- Use AI-based techniques like sentiment analysis to categorize the feedback automatically and prioritize negative ones.

- Track NPS and CSAT scores over time. You can use tools like Qualatoo that provide dedicated real-time NPS dashboards to save manual work.

- Use integration APIs to synchronize the data across your workspace tools. For example, if you work with Slack, you can integrate it with Qualaroo to automatically receive every response to the survey on the desired Slack channel.

- Track comments, brand mentions, hashtags, and posts on your social media handle and reply to customers’ concerns on time.

- Use CRM tools like BIGContacts to set alerts about customer complaint emails or urgent service calls and avoid miscommunication.

A Case Study in Customer Churn Analysis From Belron

Let’s look at a real-world example of our client Belron – a company that maintains an NPS score of 80 by utilizing AI-based sentiment analysis to reduce churn and enhance customer experience.

Belron, a leading windshield repair company, aims to provide every customer with the best and easiest experience. And the only way to do it is by understanding them and their needs.

The company gives special attention to churned customers to find the missing gaps in their store experience.

The team runs targeted surveys to collect in-depth information about the customers’ experience and analyze the data using Qualaroo’s sentiment analysis engine to uncover valuable sights in real time.

These data points are then used to optimize every touchpoint for future customers, i.e., from front-end technicians to support staff.

Install Omnichannel Service Points

Have you ever waited for half an hour on call to get in touch with a technical support engineer and then didn’t get the resolution to your issues? How did it make you feel?

We know you must have become irate or may have even switched the brand.

Now, put yourself in your customers’ shoes to understand the impact of support service on reducing customer churn in business.

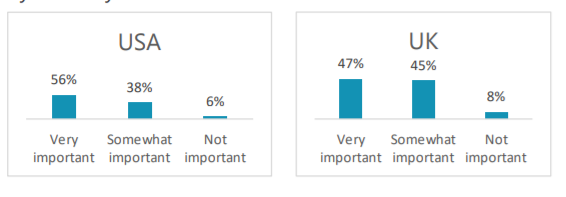

According to Microsoft’s customer service report, over 90% of customers see customer service as an important factor that affects their brand choice and loyalty.

The same study also shows that over-third customers are willing to terminate the relationship with a brand due to poor service. That’s service-related customer churn.

Even Gartner reports show low-effort service experiences promote higher repurchase probability and customer loyalty.

It makes support services, moderated or self, an important factor in improving customer churn for your business. And since people use multiple channels to reach support services, you must optimize each.

Here’s how you can create an omnichannel Service Platform to combat churn:

- Use feedback forms and surveys on your website and mobile app. You can also add a feedback sidebar to promote unsolicited feedback.

- Install a knowledge base to help customers find the required information with ease.

- Have a social media team monitor your brand’s mentions on sites like Facebook, LinkedIn, Instagram, and others.

- Reply and interact with customers’ comments online to increase engagement. Also, you can create a dedicated company page on Twitter to handle complaints and suggestions.

- Build a feedback board to collect new ideas and showcase your product roadmap.

- Add a live chat widget to your website, mobile app, and other portals.

- Use AI-based chatbots to provide 24×7 support to customers.

- Monitor service teams’ metrics, like TATs, the number of tickets or calls handled, average satisfaction ratings, etc.

Release Regular Product Updates

MySpace was a social networking giant in 2005 when Facebook was in its early stages, and it felt that it would rule the market forever.

But while MySpace remained almost the same over the years, Facebook continuously upgraded its layouts to provide an immersive experience, reacting quickly to market shifts and trends. These include wall feeds, news, games, ads, photos, likes, and live feeds.

And in 2009, Facebook surpassed the unique active users in the U.S. After that, MySpace experienced a continuous decline in users, and Facebook acquired almost 3 billion users.

Here’s another example to paint a clearer picture:

Gina Gotthilf, Former VP of Duolingo, says – ‘You know the red dot on your app which indicates a new notification or something unresolved? That led to an increase of 1.6% in the DAUs (daily active users).

Duolingo also followed the product-led growth model to increase their users from 5M to 200M in just five years. By constantly updating their app, adding new features and languages, and ensuring seamless adoption, they made the app addictive.

The moral of these anecdotes is that regular product updates are necessary to improve the product and bring in new customers.

It shows you are constantly listening to customers’ suggestions and feedback to improve the product for them.

Run Pricing Analysis

Your pricing strategy can significantly impact customer churn, especially for new users in the adoption stage. If they find the price too high or don’t get the value for money, they are more likely to leave the services.

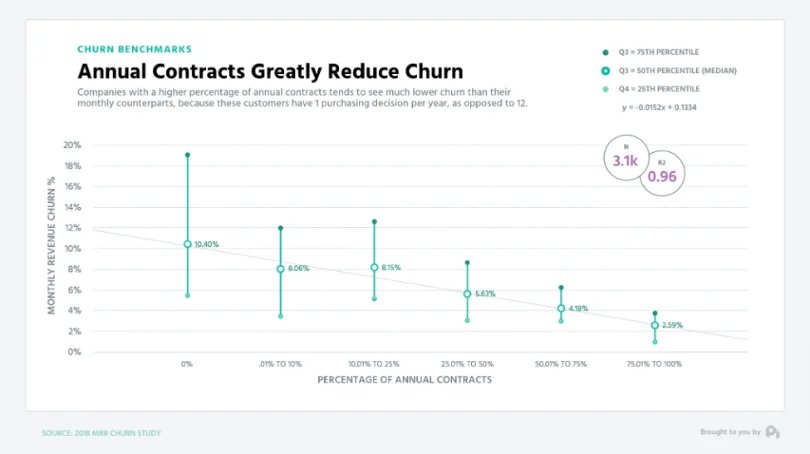

Studies show that contract or subscription length also affects customer churn. Companies offering more extended contract length experience lower churn rates. The reason is that customers can only make the decision once per year instead of 12 times.

So, how would you know what’s best for you? Run Pricing Analysis

- Use market research surveys to know how customers feel about your pricing structure.

- Look into your competitors’ pricing strategies to understand their price tiers.

- Offer a free basic plan to let customers experience product features. This small step can significantly reduce churn during the adoption stage.

- If you must reconfigure the pricing tiers, add relevant features to justify the new prices.

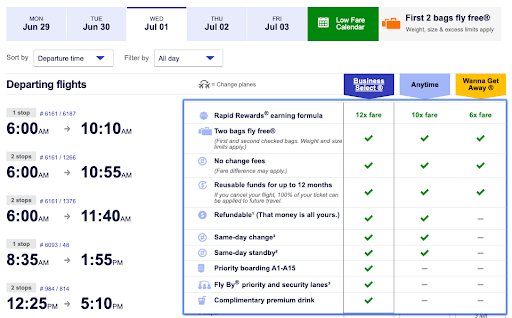

Here’s how SouthWest Airlines did it:

Southwest Airlines added a premium option-‘ business select’, to their current pricing structure. The new package bundled the high appeal and low-cost options like priority boarding, extra frequent-flier miles, and complimentary cocktails into one to deliver a better customer experience.

The result was an increase of $73 million in revenue in the first year.

Perform Value Segmentation

Not all customers are equal. Let’s understand this by a simple example:

- Suppose customers A, B, and C each spend $60 a year while customer D spends $200. Whom will you put more effort into retaining?

- The first thought could be to save three customers instead of one since the total revenue is almost equal. But let’s talk about quality.

- For year-on-year spending, customer D gives higher revenue than the other three customers.

- Plus, small order value customers have a higher tendency to shop only when a discount or offer is available.

- A customer who spends $200 per year must see some value in your brand.

It also means that the customer may be a high-value asset and shows a potential for long-term brand loyalty if they are happy. They are also more receptive to upselling and cross-selling opportunities.

That’s why you need to segment the customers based on their potential lifetime value or profit they can provide to your company.

Plus, it also helps to balance acquisition costs and profits.

Some customers leave before you can recover the amount you spend to acquire them. That’s where you need high-value customers as they spend more than their acquisition cost, thus, bringing in profits and balancing the cost of low-value churned customers.

Case study – Quantiz improves its client’s retention rate by 67.5%

Quantiz, a leading analytics company, was tasked by its client to maximize the returns on their marketing campaigns. The client wanted to identify the most and least profitable customer segments for its campaigns.

The team at Quantiz developed a sustainable customer success framework to understand different patterns that differentiated the customers. It helped the client develop pricing strategies and build customer relationships to drive more engagement.

The entire exercise improved the retention rate for the client by 67.5%.

The biggest reason for the increase in retention rates was the acquisition of relevant customers that offered greater value in terms of revenue and lifespan, which automatically reduced the number of churning users.

Run Incentivized Programs

Incentivized programs like discounts have a three-pronged effect:

- They give better prices for purchases.

- Encourage customers to return for more purchases, improving customer retention and loyalty.

- Attach an urgency to purchase before the incentive expires.

Everyone likes a good discount, and brands send enticing offers to active and inactive customers to convince them to return to the website or store.

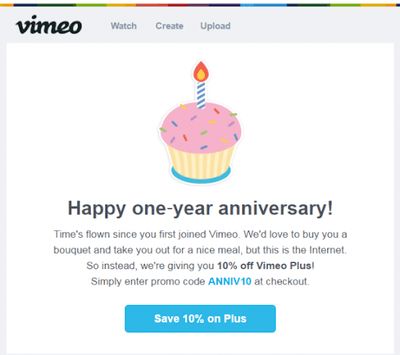

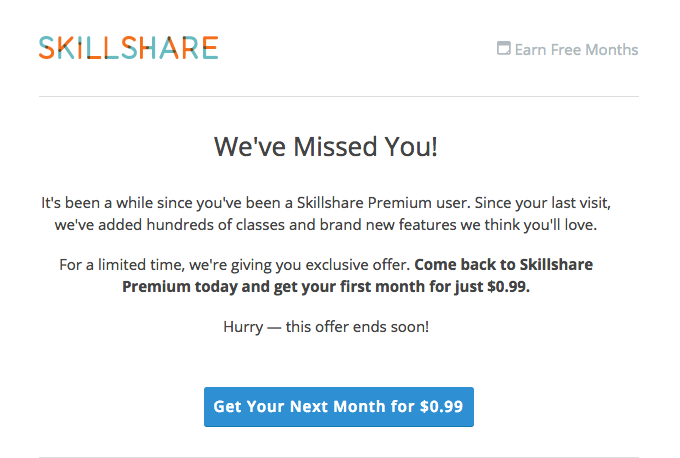

Here are a few examples of how you can use incentivized offers to reduce customer churn in business:

- Send them personalized offers on special occasions like anniversaries, birthdays, or completing an entire year with your brand.

- Use Newsletters and emails to remind churned customers about new product updates.

- If a customer used a free plan before becoming inactive, you could offer them a taste of premium features at an attractive price.

- Create urgency by sending notifications about the loyalty points’ expiration. If the customer sees that their hard-earned loyalty points are about to expire, there’s a higher probability that they might purchase to redeem those points.

Nail the Onboarding Process

Well begun is half done, and it fits perfectly for your customer onboarding process. A successful onboarding helps both product adoption and revenue stream.

You can leverage it to achieve multiple goals:

- Show unique and immersive product features to the new users

- Educate users about the product value

- Teach them how to use the product

- Generate leads by adding a simple signup form

That’s why 84% of companies see onboarding as the number one tactic to reduce customer churn and improve retention.

And good onboarding produces almost 5% higher retention rates than negatively perceived onboarding. To see what does and doesn’t work for your customers, you can set up an A/B test to optimize the onboarding.

Here are a few things you can experiment with while designing the onboarding experience:

- Add the Signup Page Before or After the Onboarding Process. You can A/B test the position of the signup page. Try adding it to the front, middle, or end of the process to see what provides the best retention rate.

- Experiment with the length of the onboarding experience. Showing the product features is excellent but don’t make it excessively long, or customers may get frustrated.

- Add the Option to let the customer decide whether to go through the onboarding process. Some may be repeat users who have already used the product, so they don’t need to waste their time retaking the tour.

Establish Better Communication

Another cause of customer churn is client mismanagement which leads to the loss of potential leads, prospects, and even regular customers. That’s why you must streamline the sales pipeline to manage client communication effectively.

Whether it’s 1-on-1 meetings or emails, your team needs to be aware of the current status of the customer, their previous interactions, and other necessary meta-data.

Here’s how to establish smooth communication with your client to increase retention:

- Find robust CRM software to manage your client data. Depending on your requirements, you can use tools like BIGContacts or Salesforce to consolidate all the customer information in one place.

- Ask your team to log all the communication transcripts in the customer’s account. These include the summary of 1-on-1 calls, emails, live chat, service calls, and any other interaction.

- Track customer activity and set up important alerts like account cancellations in your CRM.

- Analyze the prospects in your sales pipeline and design relevant product offerings to move them closer to conversion.

Time to Focus More on Retention Than Acquisition

With customers switching brands right and left, retention strategies are a solid foundation for growth. If people constantly leave your business, you cannot build a loyal customer base to produce recurring revenue.

Fortunately, small steps can help retain customers, and one of them is providing an engaging seamless experience and reducing churn rate.

Start by listening to them to find the gaps in the customer journey. These include the interaction points where customers face issues or express grievances.

For example, you can use a feedback tool like Qualaroo to deploy surveys whenever a customer contacts you via the helpdesk ticket. It will also help you to explore any previously unknown critical customer touchpoints.

Combine this with impeccable offline and online customer service; you already provide an optimized experience.

Now, you can move towards fine-tuning engagement using offers, programs, and other strategies mentioned in the blog to combat customer churn. Remember, it’s an iterative process. So gather data from your efforts and use it to refine the process in the next cycle.

Frequently Asked Questions

How is customer churn calculated?

Customer churn is calculated by dividing the total number of customers that left the business over the period by the number of customers you had at the beginning of that period.

What is churn KPI?

Churn KPI, also called customer churn rate, is the measure to track customer attrition. It is calculated by dividing the number of customers who stopped doing business with you during a specified period by the total number of customers at the beginning of the same period of time.

What is churn mean in business?

Churn indicates the customers that left the company due to poor experience. These include delays in addressing the grievances, lack of in-depth knowledge base, product issues, pricing, etc.

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!